Is buying in Brooklyn worth it?

The stories I've read about apartment ownership were either crude financial analysis or clean NYT real estate fluff. My story is neither. In reality, no matter how nice and clean your apartment is, buying and selling an apartment is MESSY.

I bought an apartment in Park Slope for 700k, renovated it and sold if for 815k 3 years later. With 175k down, I made a 60% return. But, including the renovation costs, lawyers, permits and agent fees, was it 'worth it'?

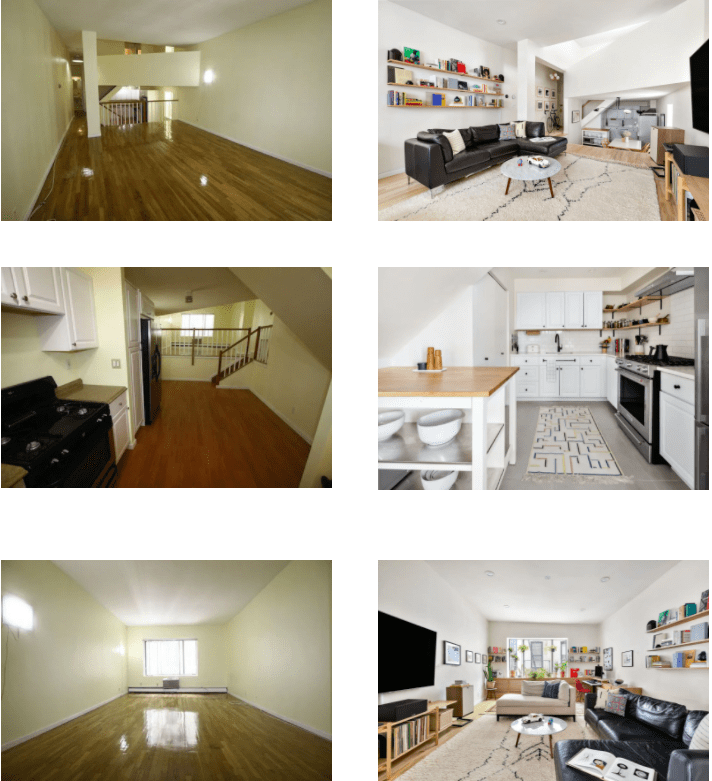

How did the renovation go?

I don't want to detail the whole renovation process, but it was both stressful and satisfying. Before on the left; after on the right.

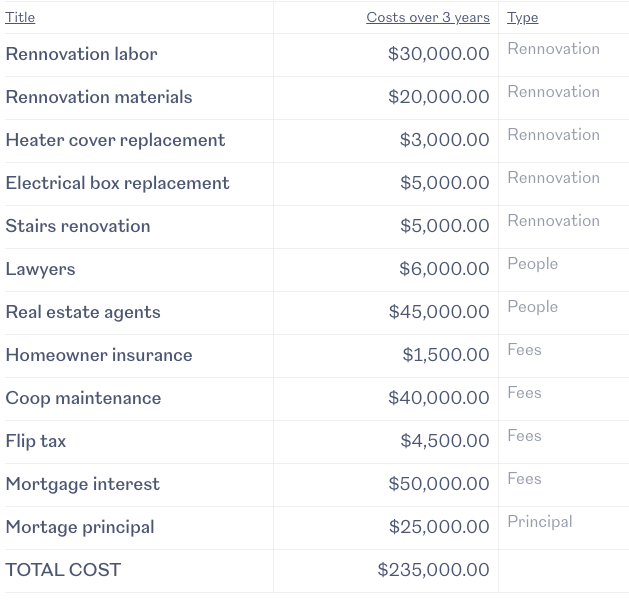

Home ownership and sale costs (rounded)

If you are curious about the various costs that come into play, below is a summary of the major cost for buying, owning and selling an apartment.

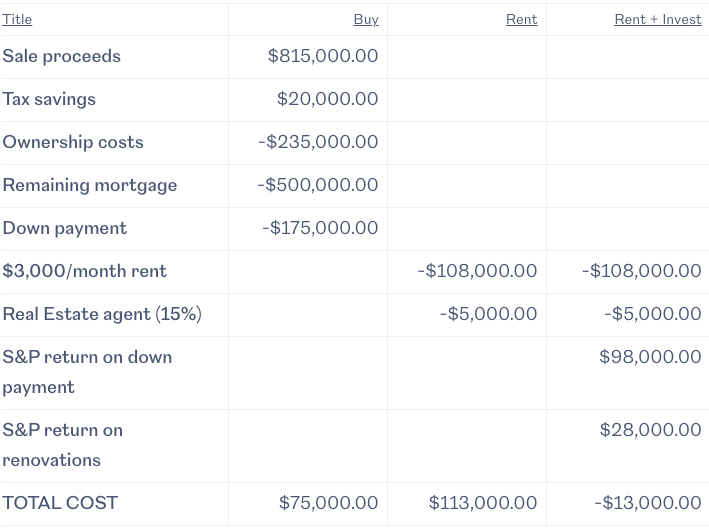

Rent vs buy calculation

Below you can see that renting was $38,000 more expensive than buying. However, if I had invested my down payment and renovation money in the stock market, renting would have been 100k cheaper!

Owning property has tax benefits but…tax benefits are complex. You can deduct mortgage interest from your federal taxes. If your existing deductions already push you into using the itemized deduction, this can be beneficial on your federal tax return. However, if you have few deductions and use the standard deduction, the mortgage deduction is less beneficial since the standard deduction is already quite high. You can technically also deduct property taxes but if you can afford property in NYC, you probably can't deduct property taxes in NY. If you are curious about tax savings, talk to a CPA.

In my case, I received about 20k of tax savings from owning property.

The price of money

The S&P returned 56% over the term of my mortgage. That would have turned my $175,000 down payment into $273,000. After 20% capital gains, I would have made $78,000. That profit would cover renting an apartment 2x the price of a comparable rental.

When people talk about why home ownership is a bad idea, they refer to the 'opportunity cost of capital'. In this instance, while buying was about $38,000 cheaper than renting a comparable apartment, I lost out on significant stock market gains. The opportunity cost only increases if you incorporate other upfront costs like the cash required to do renovations or place some value on your time.

As you can see above in the real estate agent fees and the flip tax, the transaction costs for selling an apartment are high. In addition to those fees, selling takes time. The current estimate is 5 months from listing to closing and receiving funds from the sale.

Unfortunately…the opportunity cost was not the only cost I paid.

Non-financial costs: Dust

For at least 6 months out of the 3 years, I was living in a construction site.

There were three major projects: initial renovation, replacing the stairs and replacing the heater cover.

With each project, there was some prep for construction, the doing of the construction and then trying to remove as much dust as possible. You live with construction for much longer than the construction actually takes. In a large house, you might have an extra room or outdoor space for using power tools. In NYC, if you can afford an extra non-used room, you can probably afford to live somewhere else while the construction is going on.

Since we were not able to do much ourselves, we saved cost by doing the finishing (sanding, painting and staining).

It is hard to put a dollar cost to being surrounded by dust and construction for 6 months but it is an inconvenience that would be unusual in a rental.

Non-financial costs: Permit me not

When I moved in, there was an electrical box in the apartment from 1986. Today, it is considered a fire hazard and so I hired an electrician to replace it. They replaced the box for $2,200 and permitted the job with the DOB…but then they passed away (very sad) before closing the permit. Interestingly, I could not sell my apartment with an open permit.

Thus begins an epic fetch quest to close the permit!

I'll spare you all the details but I went from contacting an ‘expediator’ (a great job title!), braving the "DOB: Now" and "DOB: Now Inspections" websites, then going into the belly of the DOBeast to finally get a piece of paper with an email on it that I used to schedule an inspection. I then… didn't pass the inspection and had to pay an electrician another couple thousand dollars to replace the electrical box (again), issue a permit (again) and be there for an inspection (again). Original work: $2,200 Fixes: $900 2nd permit: $1,500

Total cost: $4,600 (and a full day of navigating the DOB) to replace an electrical box…a job that takes an electrician less than 2 hours.

Non-financial costs: Lien on me

One kinda odd thing that increased the cost was that I had two liens on the apartment. In my brain ‘lien’ is beverage I have heard about and would probably sip in moderation if the opportunity presented itself. In bank land, having two lien means I owe my apartment to two banks at the same time.

If I were an imperialist, promising my apartment to as many banks as possible and then having them fight each other over my apartment would be a great strategy for destabilizing an industry. Unfortunately, my meager 500k mortgage was not enough to destabilize the trillion dollar banking industry.

For a rough timeline of events, I got a mortgage through Bank of America in 2017. During the past few years of low mortgage rates I unsuccessfully tried to get them to lower my rate. Instead, in November 2020, I paid about $5,000 to refinance and drop my rate from 3.75 to 2.8 which dropped my monthly payment by $500. The second bank then sold my mortgage to a third bank after a month (I have no idea why).

During the weeks before closing on the sale of my apartment, my lawyer decided to do a ‘lien search’ and found that I had a 2 liens on the apartment. One of them was from Bank of America and was made out to two people - Brennan Moore and Brennan Harold Moore. I later had to prove that they were one person in a really bizarre phone conversation with the bank. The second lien was to the bank I refinanced to but not the bank the mortgage was later transferred to (and who I pay each month). My lawyer was… confused.

Unfortunately, the person who got hurt in the confusion was me since it takes FOURTY FIVE DAYS to close a lien. This delayed the closing a month.

My favorite nugget was when a BofA customer service rep asked me if I had a fax machine. I, not thinking of efax, said 'no'. They said, 'oh… well in that case we will have to email you the documents. The email takes 3 days to arrive.'

Takeaways

- Don’t permit anything ever.

- Do regular permit searches for your apartment.

- Do a lien search after refinancing to ensure the refinance went through.

- Someone please figure out how to transfer property more efficiently

So…was it worth it?

I really feel it is disingenuous to call home ownership a good investment for most people.

A home is illiquid (selling took 5 months!) and does not provide returns comparable to the stock market at any risk tolerance. While I owned my apartment for only 3 years, my parents purchased their home for ~$90k in the late 80s and after significant renovations, sold it for ~$150k 2018. While the value of their home grew 60%, $90k invested in the S&P in 1988 would be worth over $1.8 million today. Even a much lower risk portfolio would have more than paid for a fantastic rental.

In buying a home, you are buying control and forcing yourself to save. The renovations I did were dramatic. As an owner you can do large renovations to accommodate working from home, or fix those little annoying issues part of every rental.

So, I'm happy I owned for only 3 years. I learned a lot and was able, with helpful advice from many friends and loved ones, make a space I was really proud of.

Yesterday, I was venting to my girlfriend about yet-another-fee and said I would never own again. She stopped me and said 'You like tinkering and fixing stuff. Don't kid yourself that you want to rent someone else's apartment forever. You are an owner at heart.'